EMPLOYER || CANDIDATE

EMPLOYER || CANDIDATE

Virtual Office Virtual Staff

Employer

How to Reduce Business Spending

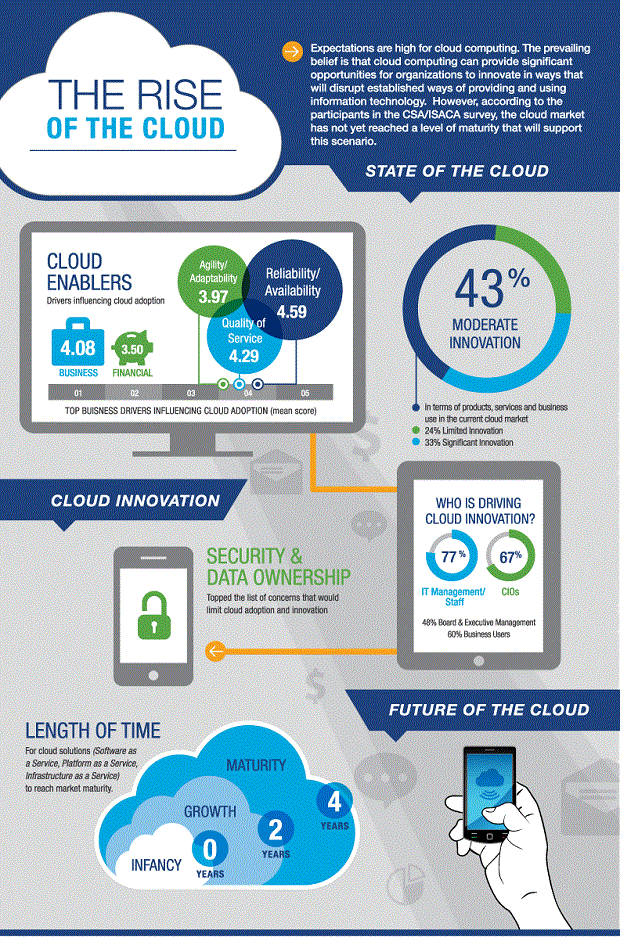

The growing skill shortage, artificial intelligence both disrupting and creating jobs

Small and mid-size businesses have a variety of expenses to contend with. Some costs are one-time-only start-up costs, such as buying equipment, designing a website or printing business materials like signs and banners.

Other costs are recurring, such as advertising fees, rent and utilities. The most extensive expenses, however, are typically those related to overhead and operating costs.

Work Space

The moment a small business moves its premises from the kitchen table or spare bedroom into rented premises is when it is at its most vulnerable. Rents and utility costs may rise without notice. The entrepreneur needs a clear business plan that estimates how much he can afford to spend on a facility.

A start-up business will not need a conference room; this can be rented by the hour. It’s also more cost-effective to share kitchens and bathrooms with neighboring offices. When clients sense that the fees they pay to a business are spent more on furnishings than services, they move on.

Payroll and Human Resources

Paying employees is one of the leading expenses for a small business. Payroll costs not only include salary, but also bonuses, commissions and profit-sharing as well.

Human resources functions often fall under the payroll expense category as it relates to costs associated with advertising for open positions, screening applicants and interviewing employment candidates. It can also include the financial investment that goes into training new employees.

Employee Benefits

Employee benefits can be costly for a small business. Benefits typically include things like employee and employee family health insurance coverage, though expansion into dental and vision care coverage can raise those costs significantly.

Small businesses that offer expanded benefits, such as tuition and/or childcare reimbursement, 401(k) or other retirement plans, long-term care or disability, can have even higher costs.

Inventory, Materials and Supplies

Buying inventory and supplies is a significant small-business expense, especially for those in the retail and food industries. Stocking merchandise often involves associated costs of shipping and delivery.

For businesses that manufacture or produce their own products, the cost of materials and production equipment is a significant investment, as are costs related to packaging and storing goods.

Overhead and Operating Expenses

Overhead and operating expenses are a top budget item for small businesses. These costs include rent, utilities, vehicle leases, office machine and equipment leasing, advertising and marketing fees.

Small businesses that own their own facilities may have reduced lease or mortgage costs but are likely to incur fees related to maintenance, upkeep and repair. Costs for company cars or delivery vehicles may be considered operating costs as well.

Taxes and Insurance

Taxes and business insurance can be a major expense in the small-business arena. Small businesses are responsible for business taxes and employee payroll taxes, franchise and industry taxes.

Business and liability insurance costs vary from industry to industry, and can be especially onerous for dangerous industries, such as construction. These fees can be particularly daunting, because they have the potential to change based on legislation and insurance industry fluctuations.

Virtual Staff Efficiency Report

What Applicants Lie About

Applicants lie on resumes much more than you can imagine, its human nature to embellish. But those embellishments can cost your business dearly. There is a tier based system that we use at Silicon Staffing to evaluate our candidates beyond screenings and background checks.

85 %

Generally Lie on Resume

34 %

34 %

Lie About Experience,

Education, Ability

11 %

11 %

Lie About Why They Left

Their Last Employer

18 %

Lie About Employer

or Occupation Held

Employee Replacement Cost

When you consider the HR and Recruiting Cost, OnBoarding, Training, Loss of Productivity in the initial month, Loss of Productivity during the vacancy and the various other factors that cant be measured but are effect such as Lost Engagement and effect on company culture you begin to realize how important making the right hire is.

How important it is to retain your good employees.

An hourly based clerk will cost your business $7000 to replace.

Mid Level Employees cost $10,000 to replace.

Senior Executives will cost $40,000 to replace.

Salaried Employee

Salaried Employee

Mid-Level Employee

Senior Executive